Gold Demand Having Less Impact As Prices Tread Water: Analysts

By Neils Christensen of Kitco NewsFriday July 26, 2013 5:25 PM (Kitco News) - With uncertainty growing in the gold market, analysts expect that retail investors will be hesitant to buy more physical gold in the near-term.

Although demand has been exceptionally strong since prices started to drop in April, Jeffrey Christian, managing director at New York-based research firm, CPM Group said that he is starting to see signs of weakening demand for physical gold.

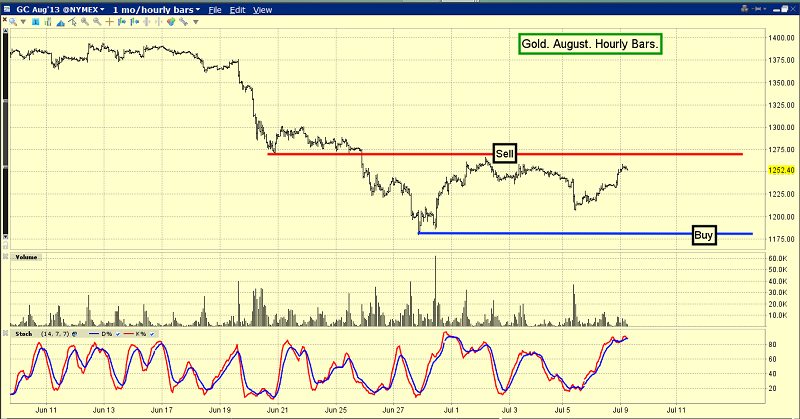

He added that even after gold’s second sharp drop in June - when Comex August gold contracts briefly dropped below $1,200 an ounce and hit a three-year low – investors were hesitant to jump in and buy bullion again.

On June 21, after gold’s second meltdown, CPM Group released an update that warned demand is starting to drop off.

“At present, there are few signs of strong demand at these lower prices on Thursday and Friday. Indian market sources reported increased demand, but said the buying levels were less than half the volumes seen in the first week of May,” the report said. “The decline in prices in the middle of April had been very timely, occurring just prior to the wedding seasons in India and China. This resulted in a substantial amount of buying from consumers in those countries, especially India. This demand helped push gold prices higher through the end of April.”

Although demand in Asia, and more specifically China, is at a record level, Christian added that he expects it to have less impact moving forward, especially as prices consolidate between support at $1,280 and resistance at $1,350.

“Demand in Asia is extremely price sensitive,” he said. “Right now we are in no man’s land. Prices are treading water and investors are hesitant to buy.”

On Thursday the World Gold Council released a report saying that because of strong demand China, the country is expected to import 1,000 metric tons of gold this year. Because of tight import restrictions in India, China is now expected to become the top gold consumer in the world.

Analysts from Barclays have also highlighted the fact that demand from China remains firm but below the record levels seen earlier in the year.

“…physical demand seems likely to remain responsive to prices. Indeed, as prices have firmed, volume traded on the Shanghai Gold Exchange has softened yet remains firm overall,” Barclays’ analysts said in a report published Friday.

Demand is even weaker in North American as the U.S. continues to show signs of a slowly improving economy. Christian said that many of the investors who bought gold were expecting either the economy to completely collapse or see higher inflation. He added that neither of those scenarios has materialized and a lot of those investors have walked away from the market.

“It would take a lot of major economic problems to get these guys to come back to the gold market,” he said. “We just don’t think that is going to happen.”

After hitting a session low of $1,179.40 an ounce on June 28, August gold prices have found some momentum and closed Friday at $1,321.50 an ounce – a 12% gain.

However, Howard Wen, analyst at HSBC, said that the rally appears mostly to be short-covering. Prices have been unable to break through resistance at $1,350, which Wen said is a sign that prices might head lower in the near-term.

“For demand to pick up we would need to see lower prices,” he said. “Most of the buyers looking for a price drop bought earlier in the year.”

Wen added they are looking at some seasonal factors that could be bullish for gold in the near-term. In India, he said they have heard that the monsoon season has been fairly positive, which means farmers will be able to buy more gold in the fall.

However if prices rise too much, Wen would expect demand to wain because people would only be able to buy so much.

“People only have so much money so it’s not a question of when they will buy but of how much they will buy,” he said.

For the next few months, especially during the slower summer period, Wen said he expects prices to trade in a range of $1,125 and $1,375.

CPM group is also not that far off from HSBC’s outlook. Christian said that looking at the long-term price trend there are indications that prices are nearing a bottom; however investors should expect more volatility in the near-term.

“We have said that we wouldn’t be surprised to see prices spike lower in July and August. We are almost finished with July so we will have to wait and see,” he said. “If prices hover around these levels until September we could see investors start to come back and buy.”

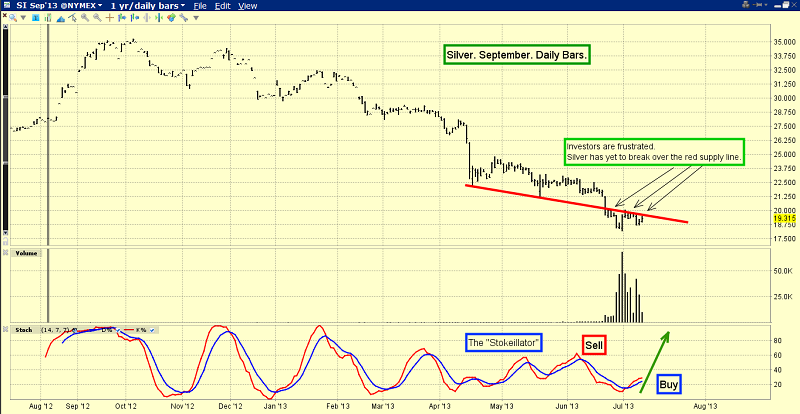

1. Investor sentiment has weakened: although it's temporary and purchases tend to pick up once a lower price level has been reached

1. Investor sentiment has weakened: although it's temporary and purchases tend to pick up once a lower price level has been reached