Look at it now, before everyone else gets ahold of it.

By Keith Fitz-Gerald, Chief Investment Strategist, Money Morning

What I'm about to say will challenge even the most steadfast gold

bears - or anyone for that matter right now who thinks that gold has

seen its better days.

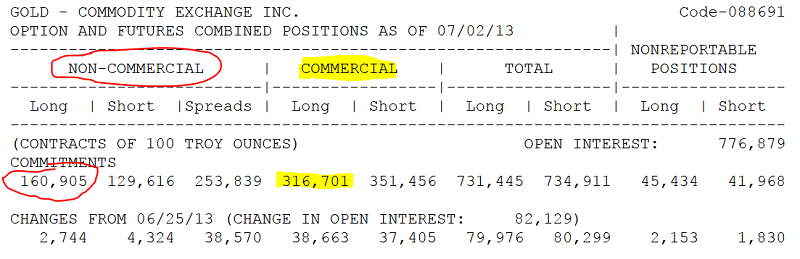

The chart below tells a story - a big story. In fact, I encourage you

to forward this to anyone you know who is serious about their money.

What I found here, with the help of Frank Holmes from U.S. Global and

one of the smartest people on earth on the potent combination of Asian

markets and commodities, is a chart that shows a truly astounding fact

about gold.

Let me walk you through it, and what it could mean to your money, your gold, and your financial future.

Courtesy U.S. Global Advisors - click to enlarge

Courtesy U.S. Global Advisors - click to enlarge

The grey backdrop is total world mining production. The blue vertical

lines represent COMEX gold deliveries. And the big long vertical red

lines? That's physical gold delivery on the Shanghai gold exchange.

The takeaway? - Chinese demand for physical delivery all by itself is nearly equal to total worldwide gold production.

That's not a misprint.

In fact, so far this year Chinese deliveries through the Shanghai

exchange account for nearly 50% of total global production all by

themselves. The COMEX that's part of the New York Mercantile Exchange

is almost an afterthought.

This is about as bullish as it gets because the basic laws of supply

and demand stipulate that whenever supply is reduced but demand remains

constant or accelerates, higher prices result.

No Stopping It

This is as immutable as the sun coming up tomorrow or the grass turning green in the spring.

This is good for the markets in general, especially with Bernanke

hell bent on keeping the "bad is good theme alive" when it comes to

further stimulus.

And this is positively great for gutsy gold investors at a time when others want to relegate it to the scrap pile.

Imagine what happens when people actually figure out that China is

buying so much gold that physical deliveries there could account for

100% of worldwide production by year's end?

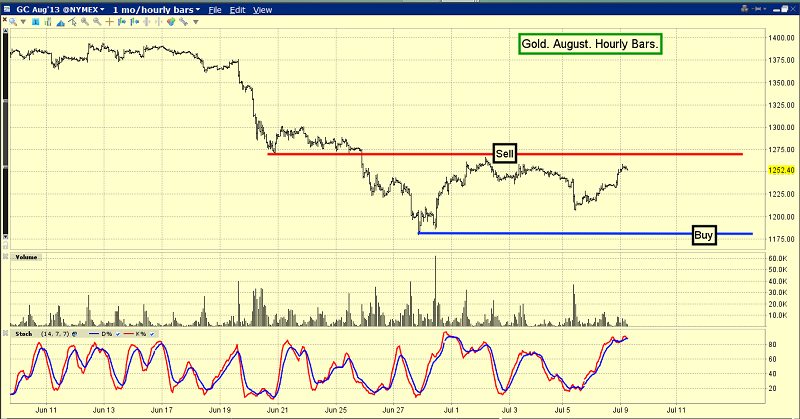

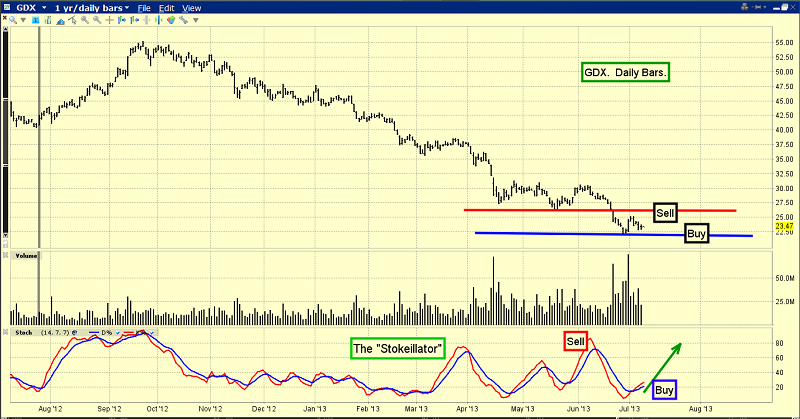

For investors wanting to play gold, there are quite a few options.

But one's the best...

Get Ready For a 21st Century Gold Rush

Purists feel owning physical gold is the only true hedge against

global turmoil and declining values in the dollar and other fiat

currencies.

For smaller investors, this typically means buying gold bullion bars,

rounds (unadorned coin-shaped pieces) or minted gold bullion coins.

Bullion bars - produced primarily by private mints like Engelhard,

Johnson Matthey PLC (LON: JMAT) and Credit Suisse Group AC (NYSE ADR:

CS) - come in an assortment of sizes to suit the needs and means of

every investor.

The smallest bars weigh just one gram, while the largest weigh 400 ounces.

Gold rounds are produced by the same private refiners, as well as

some government mints, and are also available in a variety of sizes,

typically ranging from one-tenth of an ounce to five ounces. Prices

range from as little as $15 per round over the spot price of gold at the

time of the order for smaller pieces to $40 over the spot for larger

specialty pieces.

Jewelry-type pieces, such as pendants, are also available, but generally carry slightly higher premiums.

Minted bullion coins come in a far greater variety, being produced by

most of the private refiners as well as a number of the world's

leading government mints.

Examples of the latter include the American Gold Eagle, American Gold

Buffalo, the Canadian Gold Maple Leaf, the South African Krugerrand,

the Chinese Gold Panda and the Mexican Gold Libertad.

Specialty bullion "commemorative" coins are also available from both

private and government mints, honoring everything from African wildlife

to the spouses of American presidents.

Sizes range from one-tenth of an ounce to two ounces, with the

one-ounce size being most popular and readily available. Bullion coin

prices typically track the spot price of gold, plus a premium of 5% to

6% for the one-ounce issues, which covers the cost of refining, minting

and marketing. Premiums on smaller coins can run as high as 15%.

Beware, however, that the premiums for all sizes will be considerably

higher if you buy in small quantities or want to pay by credit card

rather than with a bank draft or funds transfer.

The most important rule, whether you're buying gold bars, rounds or

minted bullion coins - or any other physical metal, for that matter -

is to deal only with reputable dealers with proven experience and

clearly stated policies and warranties. This is especially crucial if

you're purchasing by phone or online.

Don't Get Scammed

Several well-regarded, long-standing dealers in the U.S. include:

American Precious Metals Exchange (

apmex.com)

- This Oklahoma City-based firm offers both bullion and collectible

metals products, as well as storage facilities. Quotes are updated

every 15 minutes during trading hours. Purchase online or call

1-800-375-9006.

Asset Strategies International (ASI) (

assetstrategies.com)

- This Rockville, MD, firm has a large inventory of gold coins, bars

and other bullion products, and also offers regular metals markets

commentary and analysis on its website. Sales representatives are

available at 1-800-831-0007.

Goldline International Inc. (

goldline.com)

- Based in Santa Monica, CA, this company has been in business more

than 50 years and offers a full range of gold coins and bars from mints

around the globe. You can purchase online or through a sales rep by

calling 1-800-963-9798.

The Tulving Co. (

tulving.com)

- Based in Newport Beach, CA, Tulving provides 24-hour sales and

service, tracking trading and price quotes in markets around the globe.

U.S. and Canadian investors can call 1-800-995-1708.

Physical gold provides a long-term store of value, but it does carry

one added risk - the potential for confiscation, much like what

happened in 1933.

That possibility is quite real. As such, if you're seriously

considering gold as a hedge against future U.S. political or economic

uncertainty, you might consider a storage site for your coins or bars

in Canada or elsewhere offshore.

One added note for coin buyers: If what you want is a true hedge

against turmoil, inflation and a weakening dollar, stay away from

"collectible" gold pieces.

While such coins are beautiful and their value will no doubt increase

along with gold bullion, those values are subjective, they carry far

higher premiums than bullion coins and they're much harder to sell on

short notice.

By contrast, bullion coins and bars are cumbersome for investors to

trade given the price premiums, storage, shipping and insurance costs.

In this case, the ultimate trading vehicles are gold futures - the

most popular being the 100-ounce contract listed on the COMEX Division

of the Chicago's CME Group.

However, that's a fairly high-dollar/high-risk instrument for most

investors since a single contract is worth $125,000 or more at current

prices.

As such, a better vehicle for smaller investors wanting to play

gold's next rally is one of the exchange-traded funds (ETFs) or notes

(ETNs) with shares backed by actual bullion.

1. Investor sentiment has weakened: although it's temporary and purchases tend to pick up once a lower price level has been reached

1. Investor sentiment has weakened: although it's temporary and purchases tend to pick up once a lower price level has been reached